It takes a lot more than only purchasing a top-performing mutual fund if you are willing to gain higher returns from your investments. Even though you can get your hands on the list of funds delivering the highest returns over the past years through the Internet, you might end up delivering inappropriate returns in the future by making some common mistakes.

This article will help you learn about some of the most effective strategies and tips to achieve better results from your investments on a mutual fund app.

Why Invest In Mutual Funds?

Significant reasons for investing in a mutual fund are as follows:

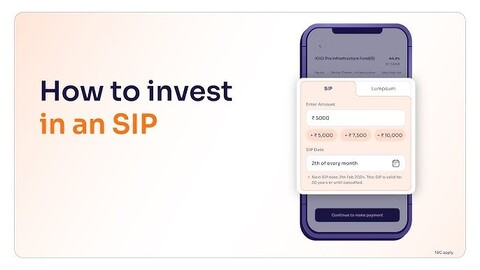

- The diversification that comes along with mutual funds across assets, such as mutual fund SIP, bonds or stocks, helps minimise the risk. Even if you begin with small investments, you get exposure to several securities.

- Your mutual fund investments are managed by expert fund managers who help you make better investment decisions on the basis of market trends and research.

- You can select from short, medium, and long-term investments. Whether planning for retirement or vacation, you can get a mutual fund to align with different needs.

Key Tips To Earn Profits From Mutual Funds:

Earning profit from SIP in mutual funds or other MF investment takes a lot more than only investing towards a top-performing fund. You must also work on the strategies after learning about multiple factors to earn higher returns. Specific tips that can help you achieve your financial goals from mutual fund investment are as follows:

1.Be aware of your risk appetite

Different mutual fund investment plans are created for different types of risk-bearing investors. Investing in a mutual fund that does not align with your risk appetite might force you to exit the fund quicker than you were planning to, eventually resulting in losses or lower returns.

2.Mutual fund portfolio diversification

Instead of depending on a particular kind of MF, ensure to diversify your portfolio with at least a few different kinds of mutual funds. This is important when a particular market segment begins underperforming, and the funds from other market segments help balance your portfolio and provide you with decent profits.

3.Be clear with your investment objective

One of the most crucial investment tips for mutual funds is to be aware of your objective. For instance, you can be aiming for retirement or any other long-term goal. In this case, you can get your hands on equity funds; however, anyone looking for tax savings must invest in the equity-linked savings scheme funds.

4.Choose funds with a lower expense ratio

The expense ratio is the annual fee that investors need to pay to the fund house. With a lower expense ratio comes a higher return on your investments. So, for any investor performing mutual fund performance analysis, it is essential to pay attention to the expense ratio of the chosen funds.

Conclusion:

Make sure to choose mutual funds that are aligned with your risk appetite, financial goals, offer long-term profits, and have a lower expense ratio. While investing in a mutual fund, it is essential to perform in-depth research, diversify your mutual fund portfolio and also learn your investment objective. By considering the following points, you can receive better returns from your mutual fund investments.