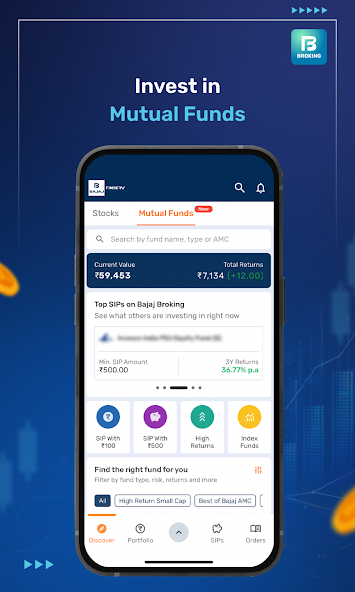

Building wealth steadily is a goal for many investors, and one effective way to achieve it is by creating a well-structured Mutual Fund Portfolio. A carefully planned portfolio not only helps in spreading risk but also provides opportunities for long-term growth. With access to the Online Share Market, investors can analyze data, track fund performance, and make timely decisions.

This will explore practical strategies to grow a mutual fund portfolio, focusing on diversification, allocation, monitoring, and disciplined investing. By understanding these aspects, investors can work toward financial stability without relying on short-term speculation.

What is a Mutual Fund Portfolio?

A mutual fund portfolio is a collection of different mutual funds chosen to achieve specific investment goals. It usually consists of equity funds, debt funds, hybrid funds, or sector-focused funds. The idea is to balance risk and reward by blending various funds in proportion to an investor’s risk tolerance and financial objectives.

Unlike a single fund investment, a portfolio offers greater flexibility. It helps in adjusting exposure to different asset classes based on market trends, which can be studied using insights from the Online Share Market.

Why Should You Focus on a Mutual Fund Portfolio?

- Diversification of Risk

A portfolio spreads investment across sectors and assets, reducing dependence on the performance of a single fund. - Flexibility in Allocation

You can adjust your allocation between equity and debt depending on market conditions or life goals. - Long-Term Wealth Building

A structured mutual fund portfolio allows investors to stay consistent, which is key for steady growth. - Ease of Monitoring

The Online Share Market provides real-time updates, helping investors review their portfolio effectively.

Smart Ways to Grow a Mutual Fund Portfolio

1. Define Your Investment Goals

The first step is clarity. Investors must define their objectives—whether it is saving for retirement, building a home, or planning education expenses. Each goal has a time horizon, and your mutual fund portfolio should align with it.

- Short-term goals may suit debt or liquid funds.

- Long-term goals work better with equity funds.

Clear goals help in deciding how much risk you should take and how much return you should expect.

2. Diversify Across Asset Classes

Diversification is the backbone of portfolio growth. A mutual fund portfolio should include a mix of:

- Equity Funds for capital appreciation.

- Debt Funds for stability.

- Hybrid Funds for balanced growth.

- Sectoral Funds for specific opportunities.

By using data available in the Online Share Market, you can identify which sectors are performing well and adjust exposure accordingly.

3. Allocate According to Risk Tolerance

Risk tolerance varies from person to person. Younger investors may prefer higher equity exposure, while conservative investors may choose a safer balance.

For example:

- Aggressive investors: 70% equity, 30% debt.

- Moderate investors: 50% equity, 50% debt.

- Conservative investors: 30% equity, 70% debt.

This structured allocation keeps the portfolio aligned with your comfort level.

4. Regularly Monitor and Review

Market conditions change over time. Reviewing your portfolio ensures you remain on track. Some funds may underperform, while others may outperform.

- Check fund performance quarterly.

- Compare with benchmarks in the Online Share Market.

- Replace consistently underperforming funds.

A disciplined review process helps protect your returns.

5. Rebalance When Necessary

Rebalancing is adjusting your portfolio back to its original allocation. For instance, if equity grows faster than debt, the portfolio may become riskier than intended.

Steps to rebalance:

- Sell some overperforming funds.

- Add more to underweighted funds.

- Keep allocation aligned with your goal.

Rebalancing prevents emotional decisions during market volatility.

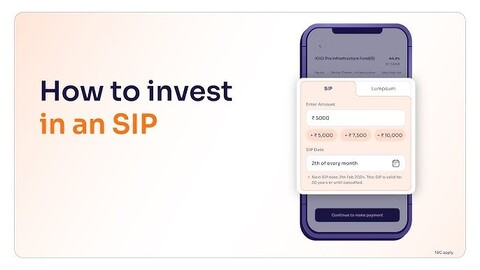

6. Invest Through Systematic Plans

Systematic investment plans (SIPs) encourage regular investing in small amounts. This approach builds financial discipline and helps in cost averaging.

By investing consistently, you avoid the temptation of timing the market and benefit from compounding returns over the long term.

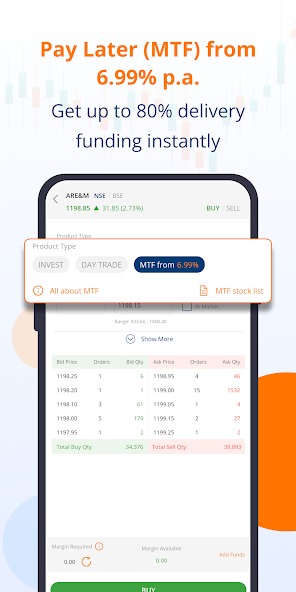

7. Stay Informed with Market Trends

The Online Share Market is a valuable resource for investors. By following sector updates, economic trends, and market movements, you can make informed decisions.

- Keep track of interest rates and inflation.

- Watch global market cues.

- Review sector performance before shifting allocations.

Staying informed strengthens your portfolio decisions.

8. Avoid Over-Diversification

While diversification reduces risk, excessive diversification can dilute returns. Holding too many funds makes it difficult to monitor performance effectively.

A good portfolio usually has 5–7 well-chosen funds covering different asset classes. Quality over quantity ensures easier tracking and stronger results.

9. Focus on Consistency, Not Timing

Market fluctuations are normal. Instead of chasing short-term highs, focus on consistent investing. Even during market downturns, disciplined contributions can reduce overall cost and provide better returns in the future.

Consistency is the foundation of a growing mutual fund portfolio.

Common Mistakes to Avoid

- Ignoring Portfolio Review: Neglecting performance checks can lead to poor results.

- Emotional Investing: Avoid shifting funds based on fear or excitement.

- Short-Term Focus: Mutual funds are designed for medium to long-term goals.

- Overreliance on a Single Asset: A portfolio heavily tilted toward one asset can increase risk.

By avoiding these mistakes, you can build a portfolio that supports your financial goals.

Conclusion

Growing a Mutual Fund Portfolio requires planning, patience, and discipline. With clear goals, proper allocation, diversification, and timely rebalancing, you can steadily build wealth. The Online Share Market provides valuable insights for tracking trends and making informed decisions.

Remember, success comes not from chasing quick gains but from consistent, well-planned investing. By following smart strategies, your mutual fund portfolio can become a reliable tool to achieve long-term financial stability.