Investing is an essential part of growing wealth, and two popular methods of doing so are trade and SIP mutual funds. While both approaches have their unique advantages, understanding their workings is key to maximizing returns and managing risk. This guide delves into the fundamental differences between trade and SIP mutual funds, helping you decide which is the better option for your financial goals.

What is Trade?

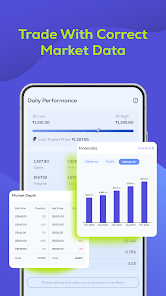

Trade refers to the buying and selling of financial assets like stocks, bonds, commodities, or currencies. It involves short-term investment strategies where the objective is to capitalize on market fluctuations. Traders closely monitor the markets and make decisions based on current price movements, often buying and selling assets within the same day, week, or month.

Key Features of Trade:

- Short-Term Focus: Trade typically aims for short-term gains, with positions held for a relatively short period.

- Market Timing: Traders need to predict price movements accurately to maximize profits.

- Active Management: Unlike passive investment strategies, trade requires constant monitoring of markets.

- High Risk, High Reward: Since trades can yield significant profits, they also come with increased risks.

What is a SIP Mutual Fund?

SIP mutual funds (Systematic Investment Plans) are long-term investment tools that allow you to invest a fixed amount of money at regular intervals (e.g., monthly). Unlike trade, SIPs are designed to take advantage of rupee-cost averaging, a strategy that reduces the impact of market volatility over time. SIPs are ideal for investors seeking steady growth over an extended period.

Key Features of SIP Mutual Funds:

- Long-Term Focus: SIPs are best suited for investors who want to grow their wealth over several years.

- Rupee-Cost Averaging: Regular investments reduce the impact of market fluctuations and help average out the cost of assets.

- Disciplined Investment: SIPs encourage a disciplined, automated approach to investing.

- Lower Risk: Since SIPs are spread over a long period, they help mitigate the risks associated with short-term market volatility.

Trade vs. SIP Mutual Funds: Key Differences

- Investment Horizon:

- Trade: Typically short-term, requiring quick transactions and constant market monitoring.

- SIP Mutual Funds: A long-term strategy designed for steady wealth creation over time.

- Risk Level:

- Trade: Higher risk due to the volatility and unpredictability of short-term market movements.

- SIP Mutual Funds: Lower risk as the investments are spread over a longer duration, allowing for compounding and reduced impact of short-term market swings.

- Time Commitment:

- Trade: Requires significant time and effort to analyze markets and make timely decisions.

- SIP Mutual Funds: Less time-consuming, as the investments are automated, requiring minimal intervention.

- Return Potential:

- Trade: Offers the possibility of higher returns in the short term, but comes with higher risks.

- SIP Mutual Funds: Provides stable and consistent returns over the long run with lower risks.

Benefits of Trade

- Liquidity: Traders can quickly buy and sell assets, giving them access to cash more rapidly than long-term investments.

- High Return Potential: Successful trades can yield substantial short-term profits if market timing is right.

- Diversification: Traders can access a wide variety of assets and markets, providing multiple opportunities for profit.

Benefits of SIP Mutual Funds

- Discipline: By automating your investments, SIPs instill a disciplined approach to saving and growing wealth.

- Compounding: The power of compounding ensures that your earnings generate further earnings, maximizing long-term growth.

- Lower Emotional Involvement: SIPs are less stressful compared to active trading, as they are set and forget, letting you avoid the daily fluctuations in the market.

Which Option is Right for You?

Choosing between trade and SIP mutual fund depends on your personal financial goals, risk tolerance, and time availability. If you’re looking for quick profits and have the time to actively manage your investments, trading might be more suitable. On the other hand, if you prefer a hands-off approach and want to grow wealth steadily over time, SIP mutual funds are a better option.

Consider Trade If:

- You can dedicate time to market analysis and decision-making.

- You are comfortable with higher risk and potential losses.

- You seek quick, short-term gains from fluctuating markets.

Consider SIP Mutual Funds If:

- You prefer long-term, steady wealth creation.

- You want to minimize risk and avoid frequent market monitoring.

- You are looking for a disciplined and automated way to invest regularly.

How to Start Trading

To get started with trading, it’s essential to:

- Research Markets: Study the assets you’re interested in, whether it’s stocks, commodities, or forex.

- Develop a Strategy: Choose a trading style that matches your risk appetite, whether it’s day trading, swing trading, or long-term trading.

- Use Trading Tools: Leverage market analysis tools to stay ahead of trends and make informed decisions.

- Set Risk Management Limits: Establish stop-loss orders and trading limits to minimize potential losses.

How to Start a SIP Mutual Fund

For SIP mutual funds, the process is more straightforward:

- Choose a Mutual Fund: Research and select a mutual fund that aligns with your financial goals and risk tolerance.

- Set Investment Amount: Decide on a fixed amount you can invest at regular intervals.

- Automate Payments: Set up automatic deductions from your bank account to ensure timely contributions.

- Stay Committed: Stick to the plan and avoid withdrawing your investments prematurely to benefit from long-term growth.

Conclusion

Both trade and SIP mutual funds offer viable paths to financial growth, but they cater to different types of investors. If you’re an active investor looking for short-term gains and are comfortable with market risk, trade may be the right option. Conversely, if you’re aiming for long-term, steady wealth creation with lower risk, SIP mutual funds are ideal.

The key is to evaluate your financial objectives and risk tolerance before deciding. You can also combine both strategies for a more diversified portfolio, balancing the high-risk, high-reward nature of trade with the steady, low-risk returns of SIP mutual funds.